The British tax authority, His Majesty’s Revenue and Customs (HMRC), is using the country’s register of beneficial ownership (BO) to identify potential undeclared tax. While the impact of HMRC’s action has yet to be seen (e.g. amount of additional tax paid), this demonstrates yet another tangible use for such registers. HMRC’s action could also provide verification of some of the data in the register.

BO registers capture information on the natural persons who directly or indirectly own or control companies or legal arrangements. The UK’s register is known as the Register of People with Significant Control (PSC), and BO registers exist across the EU and increasingly in other parts of the world. The purpose of a BO register is often described as tackling corruption, money laundering and terrorism financing. But BO registers only form part of the suite of information held by governments, and there are opportunities for governments to use BO data in other ways.

Income tax in the UK is collected through a self-assessment regime. Some individuals receive a request to complete a tax return, if HMRC knows that their circumstances warrant one. However, in some cases, individuals need to be proactive and complete and submit a return if the nature and level of their income requires one. There is no universal obligation to submit a return, and many individuals with a single employment and tax collected at source through payroll, never submit a tax return.

This creates a problem, in that HMRC will never have a complete set of tax returns for everyone, and so need to use other means to identify individuals who should be submitting a return, but aren’t. So what clues can HMRC look for?

The most obvious thing to look for is wealth. Those living in large houses, with nice cars and expensive holidays are likely to need to be submitting a tax return. But going down that route is labour-intensive, and would require information on the income and assets of individuals which would most likely come from….. their tax returns.

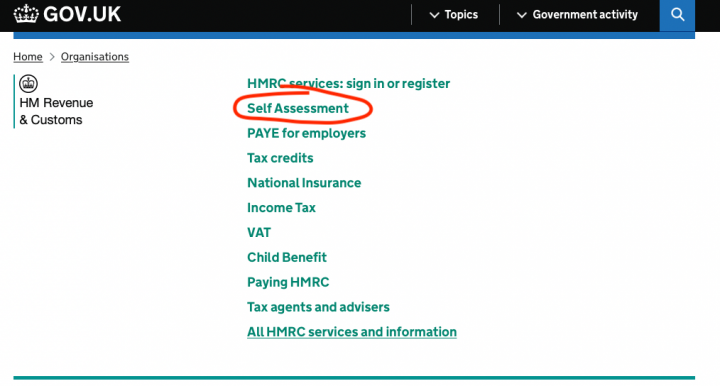

HMRC uses various investigation methods to identify those who are not declaring income or capital gains, but the latest one is to use the PSC register.

HMRC has identified individuals who appear on the PSC register who:

- Declared income on their 2020/21 tax return of less than GBP100,000 (approximately USD118,000), or

- Are not currently submitting tax returns at all.

These individuals have been sent letters (presumably to the address recorded for them on the PSC), inviting them to consider whether there is any income or gains associated with their role as a PSC, which has not been correctly reported. Will this result in a flood of tax returns? Probably not, although there may be some individuals who have inadvertently failed to declare something, perhaps related to share options. Given that the letters do not contain any information suggesting that HMRC has evidence of undeclared income, it is unlikely to flush out a determined tax evader.

The letters may also flush out some other information that will help make the data in the register a little more reliable. Some individuals may realise that they need to update their PSC Register entry as they are no longer a company owner, or their level of ownership has fallen below the reporting threshold (25%).

HMRC’s letter is a good example of how linking together BO data from another agency with information held by the agency can be used to identify potential discrepancies. The PSC Register is administered by Companies House, the UK’s corporate register and is a separate entity.

So what can other countries be doing? The most important take-away from this is that BO registers should not sit in silos. The information collected can be used for multiple reasons, and advantage should be taken of all of these uses.

In the meantime, the outcome of HMRC’s exercise could provide important evidence for the use of beneficial ownership in optimising tax payments.

Michael Barron and Tim Law are independent consultants that have advised governments on four continents on implementing effective beneficial ownership reporting systems.